WHAT IS GST

GST (Goods and Services Tax) is an Indirect tax that has replaced many other indirect taxes in India, such as excise duty, VAT, and services tax. As per the changes on the 32nd council it is necessary for each and every business to register themselves under the GST scheme if the overall annual revenue crosses Rs.40 lakhs. Along with that, the North eastern states of India have an option to choose between 20lakhs and 40 lakhs. Once you are registered, you will receive a unique 15digit number i.e GSTIN

BENEFITS of GST REGISTRATION

With the GST, Tax evasion is minimized.

Previously there were many other service taxes like VAT, each of which had in own return & compliances Now, there is only one common tax i.e GST.

Boosts Revenue efficiency

Small trader benefit from the composition scheme

Supports interstate transactions

Online process

Reduces cascading effect

WHO IS REQUIRED TO GET GST REGISTRATION

Any business whose turnover in a financial year exceeds Rs 20 lakhs (Rs10 lakhs for special category states in GST.)

Any entity or supplier dealing in inter-state supply of goods.

Casual taxable person

A person who supplies through e-commerce companies

Input service distributor and its agent

TYPES OF GST IN INDIA

CGST he Central government levies CGST on the intra-state transactions of goods and services. It is levied alongside SGST or UGST, and the collected revenues are shared equally between the centeral and the state.

SGST A State government levies SGST on the intra-state transactions of goods and services. Revenue earned is collected by State Government . SGST subsumes earlier taxes like purchase tax, luxury tax, VAT, etc.

IGST When a transaction of goods and services is inter-state in nature, an IGST is levied on them. It is applicable to imports and exports as well. State and central governments share the revenue generated from this tax.

UGST For union territories like Chandigarh, Puducherry and Andaman and Nicobar Islands, a Union Territory Goods and Services Tax or UGST replaces SGST.

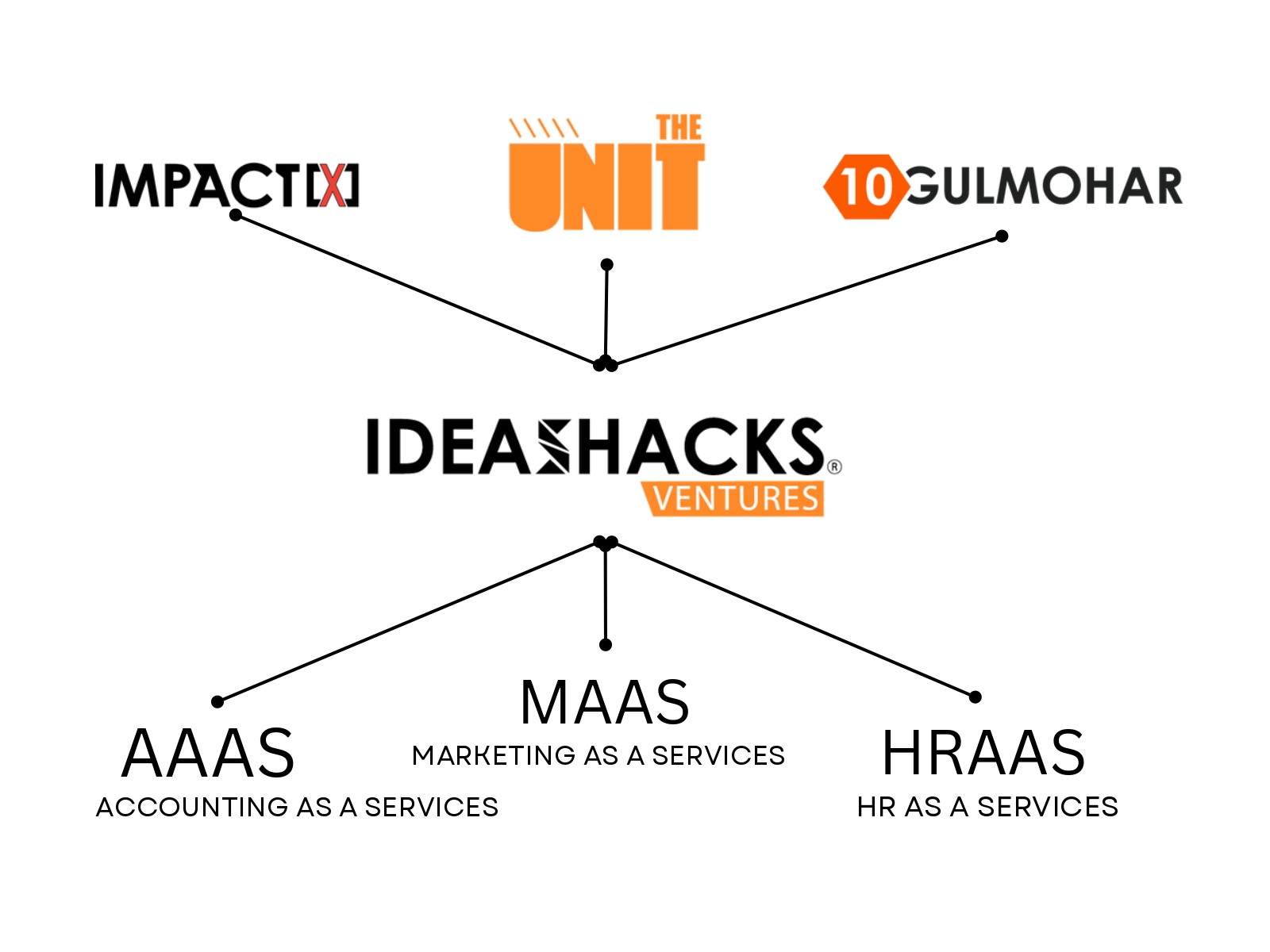

WHY CHOOSE IDEASHACKS ?

- We have well trained GST experts.

- you have to do is provide your documents,and without any delay our expert team will initiate the process.

- Speedy Approval of documents.

- Simple procedure foe GST registration in Delhi

- Complete the process at the most affordable price and provide the GSTIN.

Sole Proprietor

Firm

- PAN card

- Aadhaar card

- Passport size of the photo

- Cancelled check

- Documents for Business Address (Electricity bill, NOC, lease agreement)

Private Limited

Company

- PAN card of the company

- Incorporation certificate

- MOA and AOA

- Pan card of all the directors with photographs

- Passport size of the photo

- Cancelled check

- Documents for Business Address (Electricity bill, NOC, lease agreement)

Partnership or LLP

Firm

- Partnership deed

- Pan Card

- Business address documentation (NOC, electricity bill, lease, etc.)

- Registration Certificate

#FutureForward GST Services For Meaningful Growth

Efficient and Effective GST Services for Startups, MSMEs, SMEs

EXPERT SERVICES

Well Trained GST Experts. All you have to do is provide your documents, and without any delay our expert team will initiate the process.

SERVICE AT THE SPEED OF LIGHT

Speedy Approval of Documents. IDEASHACKS delivers new GST Registration in maximum 3 Days.

EXTENSIVE EXPERIENCE

7+ Years of Experience of delivering on GST Services like GST REGISTRATION and GST FILING for our esteemed partners.

STARTUP PRICING

Prices are empathetic to the Micro Small and Medium Enterprises.

#STARTTOGETHER WITH BUSINESS SUPPORT SERVICES

Accelerate With Us

GST SERVICES Starting From

₹500+GST

- GST Registration

- GST Filing

- Compliance Maintained

- Reporting and Guidance

- Customer-First Service

- Prime Virtual Office Available as Add On

ESTABLISH BUSINESS Starting From

₹10,000+GST

- Private Limited Registration

- Startup India Recognition

- Seamless Process

- Compliance Focused

- Customer-First Service

- Prime Virtual Office Available as Add On

VIRTUAL OFFICE Starting From

₹14,000+GST

- Prime Corporate Address

- Gst Registration

- Registered Office

- Place Of Business

- Mail Handling Services

- Quick and Efficient Service

FREQUENTLY ASKED QUESTIONS

Your Queries Answered

Is GST registration mandatory?

Yes, GST registration is mandatory once your turnover exceeds the specified threshold limits.

What do you GST identification number or GSTIN?

GSTIN is a unique 15 digit identification number assigned to the business entity. It is the short or Goods and Services Tax Identification number obtained once the person is registered under the GST regime.

How can I get my GST number?

Just get in touch with our team and provide all the required documents. Our GST registration experts will complete GST registration and resolve all your queries.

Can I take multiple GST registration within a state?

Yes, a business can apply for any number of GST registrations within a state.

Is GST registration required for startups?

Yes, it is mandatory to get register under GST for startups.

How to get GST registration for a Startup?

You can reach out to our GST experts at IDEASHACKS to complete GST registration quickly. Fix an appointment now on our website

How to get GST registration for a Startup?

You can reach out to our GST experts at IDEASHACKS to complete GST registration quickly. Fix an appointment now on our website

IN THE NEWS

KNOW ABOUT OUR PAST, PRESENT AND FUTURE

#GETCOMPLIED WITH TOP-NOTCH BUSINESS SERVICES

Accelerate With Us

Address

IDEASHACKS VENTURES PRIVATE LIMITED

DELHI NCR: Metro Pillar 564, Faridabad

Haryana - 121003

NEW DELHI: S/F I-39 Jangpura Extension

ventures@ideashacks.com

New Delhi - 110014

CHANDIGARH: Coming Soon to Punjab

ventures@ideashacks.com

Phone: +91 8448777687

Links

Careers

Impact[X] Media

Gurugram at 10Gulmohar

Faridabad at The Unit

Coming Soon to Punjab

STARTUP INDIA CERTIFICATE